Blog

Cloud-Based Invoice Approval: 5 Key Features for AP Teams

22 Oct

Blog

22 Oct

The world of finance has gone digital, and your accounts payable (AP) workflow shouldn’t be stuck in the past. Tedious manual invoice approvals belong in the days of paper cuts and metal file cabinets. Today, businesses like yours are leveraging cloud-based invoice approval systems to streamline your AP workflow, eliminating inefficiencies and reducing errors.

Whether you’re drowning in a sea of invoices or just looking to modernize your AP processes, cloud-based systems are the way forward. Let’s explore the key features of invoice approval software that leverage cloud functionality and how you can use them to your advantage.

Key highlights:

The AP invoice approval workflow can be fraught with challenges—especially for businesses still using manual methods. Some of the most common bottlenecks include:

| Challenge | Impact on AP Process |

|---|---|

| Invoice Overload | Delays, errors, strained vendor ties |

| Approval Delays | Missed payments, inefficiencies |

| Lack of Visibility | Bottlenecks, difficulty tracking |

A cloud-based invoice approval system helps solve these challenges with accounts payable invoice workflow automation and increased transparency. Real-time visibility into invoice status and notifications keep things moving smoothly so your team can avoid unnecessary bottlenecks.

Cloud-based invoicing is the modern solution to an age-old problem: managing incoming invoices, getting them approved, and ensuring vendors are paid on time—all without breaking a sweat. Traditional accounts payable team processes often involve time-consuming manual processing, multiple spreadsheets, and back-and-forth email chains for approvals. These outdated methods lead to bottlenecks, delayed payments, and—let’s be real—frustrated AP teams.

With cloud-based invoice approval, these inefficiencies are automated, ensuring that invoices flow smoothly through your approval process, no matter how large or dispersed your team may be. Plus, because it’s cloud-based, you can access and approve invoices from anywhere with an internet connection.

So, why exactly is cloud-based solutions are such a game-changer for modern businesses? Let’s take a look at the essential features you should be on the lookout for.

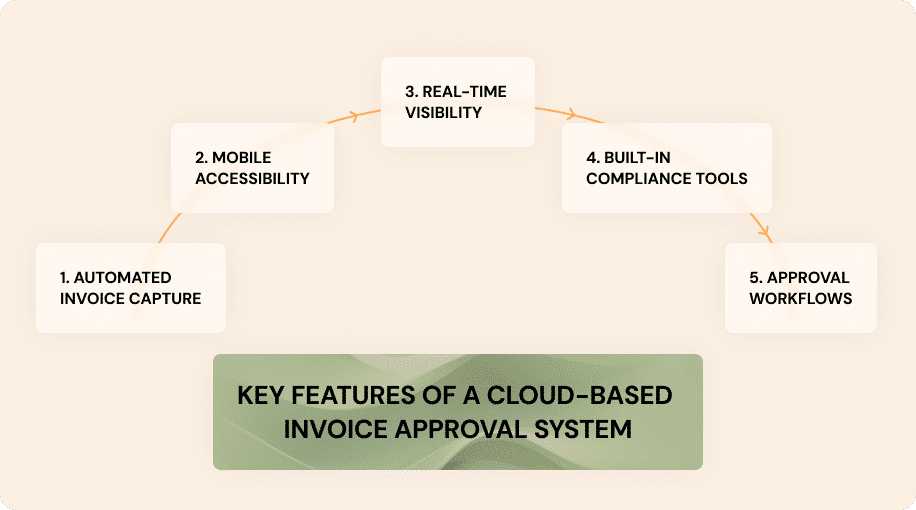

The benefits of invoice approval workflow software go far beyond just speeding things up. It’s about making the entire AP workflow more accurate, secure, and efficient. Here are the standout features you should expect from a high-quality cloud-based system:

Choosing the right cloud-based invoice approval system can feel like navigating a tech jungle. But fear not, we’ve narrowed it down to five essential features that will set you up for success.

A top-tier system should be purpose-built for your existing ERP platform such as ExFlow, which is natively embedded into Dynamics 365 Business Central and Finance & Operations. This ensures that financial data flows automatically between systems, reducing manual data entry and increasing accuracy. Look for a solution that works natively within your ERP to save time and reduce operational headaches.

Your business isn’t static—your AP system shouldn’t be either. A scalable solution grows with you, whether you’re adding new team members or handling more vendors. Flexibility is key, especially as your invoice volume increases.

Every business is unique, and your accounts payable approval workflow process should reflect that. A strong system allows you to customize workflows based on specific rules like invoice amount, department, or vendor. This makes sure the right people sign off on the right things without unnecessary holdups.

| Feature | Importance |

|---|---|

| Embedded within ERP | Ensures smooth data transfer |

| Scalability | Grows with your business |

| Customizable Workflows | Adapts to unique approval needs |

| Audit Trails | Increases accountability and security |

| Real-Time Reporting | Offers insight into the AP process |

Cloud-based systems provide a transparent audit trail for every step of the process. From invoice submission to approval, you can track who did what and when. This feature doesn’t just enhance accountability; it also strengthens your internal controls, reducing the risk of fraud or human error.

If you’ve ever wondered, “Where did that invoice go?” you’ll love real-time reporting that provides up-to-date metrics and analytics on your pending invoices, statuses, and overall performance. This transparency helps finance teams stay on top of payments and make data-driven decisions.

A dynamic frontrunner in electronic invoice approval software is Approval Web, which is part of the ExFlow solution embedded within Dynamics 365. With this tool, not only do you get native ERP inclusion, but the functionality that allows users to access invoices, approve them, and monitor their status from a centralized web interface.

ExFlow Approval Web makes it easy for approvers to:

This level of accessibility and control over the approval process makes ExFlow stand out from other cloud-based solutions. Approvers no longer need to switch between multiple systems or be tied to their office to manage the workflow. With ExFlow, all your AP needs are handled smoothly within the Dynamics 365 ecosystem.

For businesses already using Dynamics 365, the implementation of a cloud-based system like ExFlow AP is a transformative step. Merging cohesively with your existing ERP, the system automates every step of the AP invoice approval workflow—from capturing invoice data to getting final sign-off.

The process starts with capturing invoices automatically. Using advanced tools like Optical Character Recognition or Electronic Data Interchange, the system extracts key data from incoming invoices, such as vendor name, invoice amount, due dates, and line items.

This data is then uploaded directly into the system without requiring manual entry, reducing human error and saving time. OCR technology ensures that even paper invoices can be digitized, while EDI facilitates the seamless exchange of electronic invoices from vendor systems.

Key Benefits:

Once the invoice data is captured, it moves into the AP invoice approval process. Here, invoices are routed to the appropriate approvers based on pre-configured rules like department, invoice amount, or vendor type. For instance, invoices over a certain threshold may require multiple levels of approval, while smaller amounts might only need a single sign-off.

With an invoice approval solution, stakeholders receive real-time notifications, allowing them to approve, reject, or request more information with just a few clicks. Since the system is cloud-based, approvals can be made from any device—desktop, tablet, or smartphone—so your team can stay on top of things even while traveling.

Key Features:

Visibility is crucial in AP processes, and with cloud-based invoice workflow software, users can track the status of each invoice in real-time. The system provides a dashboard that shows where every invoice is in the workflow—whether it’s awaiting approval, being reviewed, or scheduled for payment. This visibility eliminates the need for back-and-forth emails or phone calls asking, “Where’s that invoice?”

Real-time monitoring also allows finance teams to flag bottlenecks before they cause delays. For example, if an invoice is stuck in a particular stage, managers can step in to troubleshoot, reassign tasks, or adjust approval thresholds.

Key Benefits:

After the invoice is approved, it’s automatically posted into Dynamics 365 or another integrated ERP system for payment. The system can trigger automatic payments based on payment terms or schedules, ensuring vendors are paid on time without manual intervention. You can also configure settings for early payment discounts, helping your business save money by optimizing payment timing.

Once the payment is made, the system updates the invoice status and notifies all relevant parties, closing the loop on the transaction. The entire process is recorded in the system, ensuring full traceability for future audits.

Key Features:

With the right system in place, businesses can handle higher volumes of invoices more efficiently, improving vendor relationships and cash flow management.

The future of accounts payable department workflows is in the cloud—and it’s time your business got on board. A cloud-based invoice approval system doesn’t just improve efficiency; it reduces errors, enhances compliance, mitigates risk, and gives you real-time insights into your AP processes.

With ExFlow, your organization can achieve these benefits through:

By focusing on scalability, built-in solutions to help you leverage your ERP investment and customizable workflows, you’ll not only streamline your accounts payable but also prepare your business for future growth.

Book a demo today and discover how ExFlow can help streamline your AP invoice approval workflow.