ExFlow offers a built-in solution for Microsoft Dynamics 365 Business Central and Finance and Operations accounts payable processes, streamlining and automating the supplier invoice workflow, delivering better control and higher efficiency, which saves you time and money.

The best built-in AP Automation Solution for Dynamics 365

- ExFlow AP is specifically designed for D365 Business Central and Finance & Operations

- Single source of truth by leveraging Microsoft’s advanced data security

- No custom development needed

- Save time and resources

- Little to no additional training required for the finance team.

Best in class accounts payable

- 2.1x more invoices processed “straight through”

- 51% less time spent responding to supplier inquiries

- 81% more efficient to process a single invoice

- 79% lower invoice processing cost

Simplify AP Workflow Automation with ExFlow

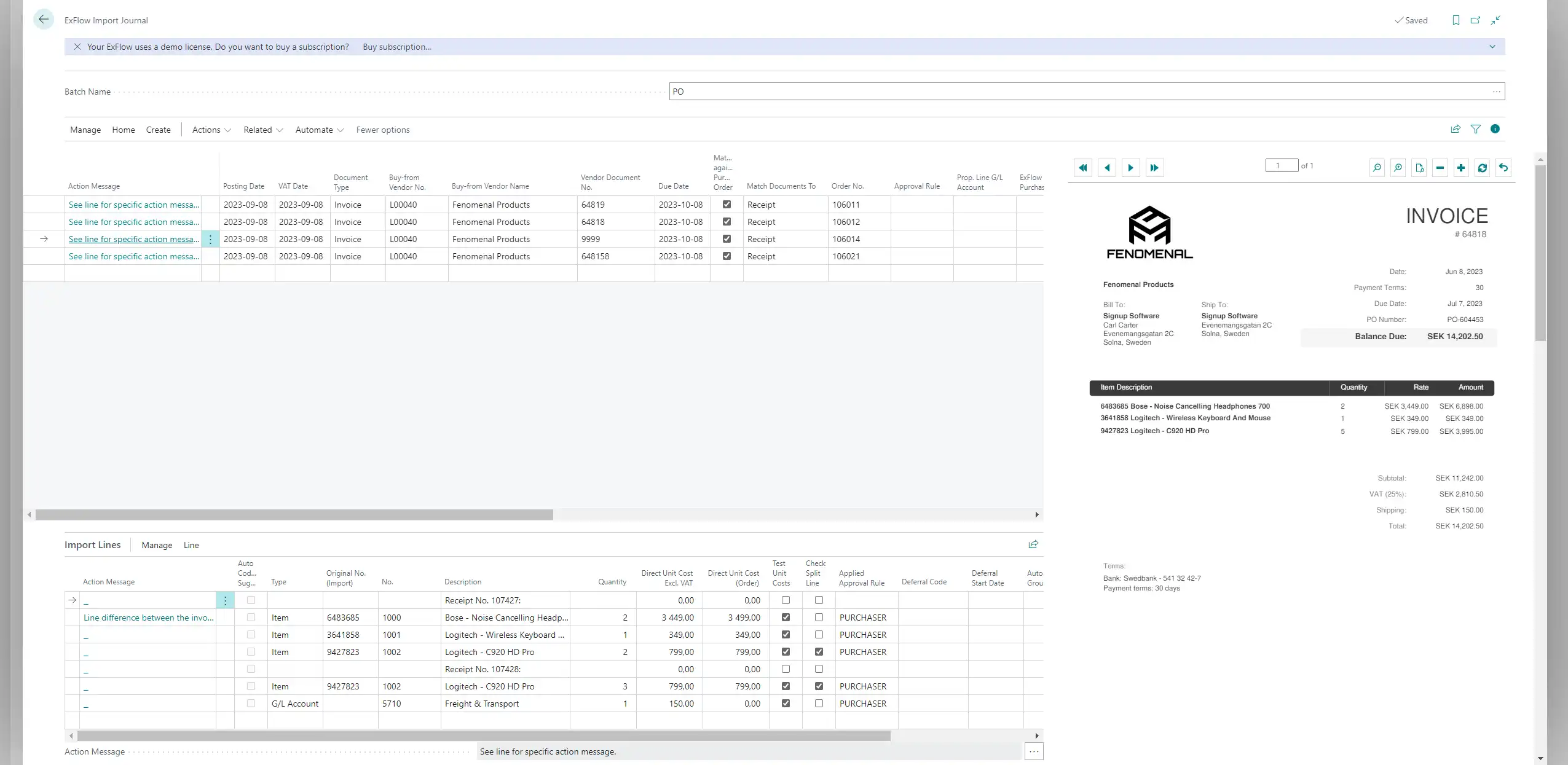

Effectively managing accounts payable workflow processes has become a critical part of running a well-functioning finance operation. Accuracy, efficiency, and strong financial oversight all depend on getting this process right. Practices like three-way matching, timely invoice approvals, and detailed audit trails are essential, but they can be difficult to maintain without the right support.

ExFlow helps bridge that gap by giving teams the tools they need to stay consistent, compliant, and in control.

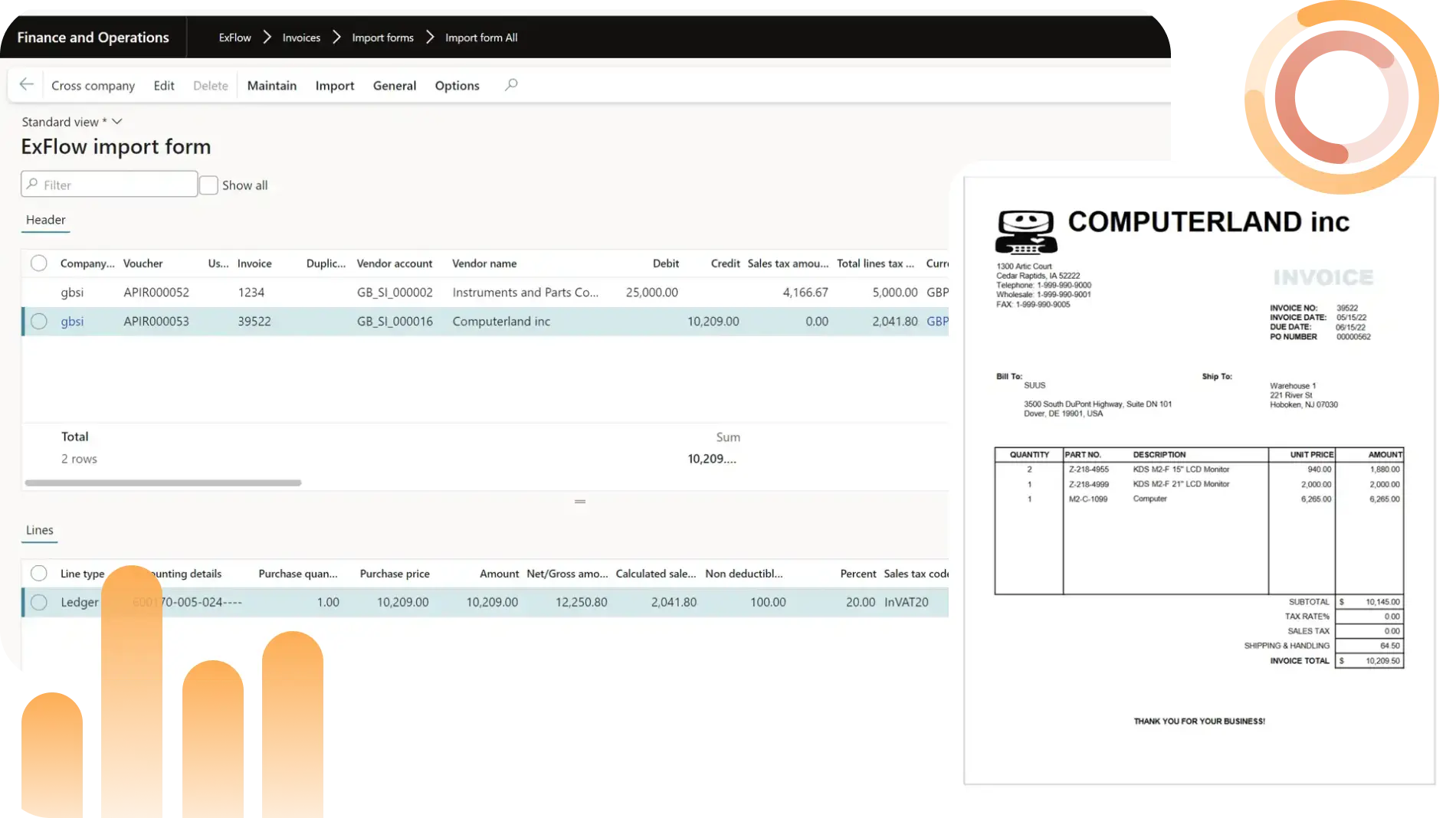

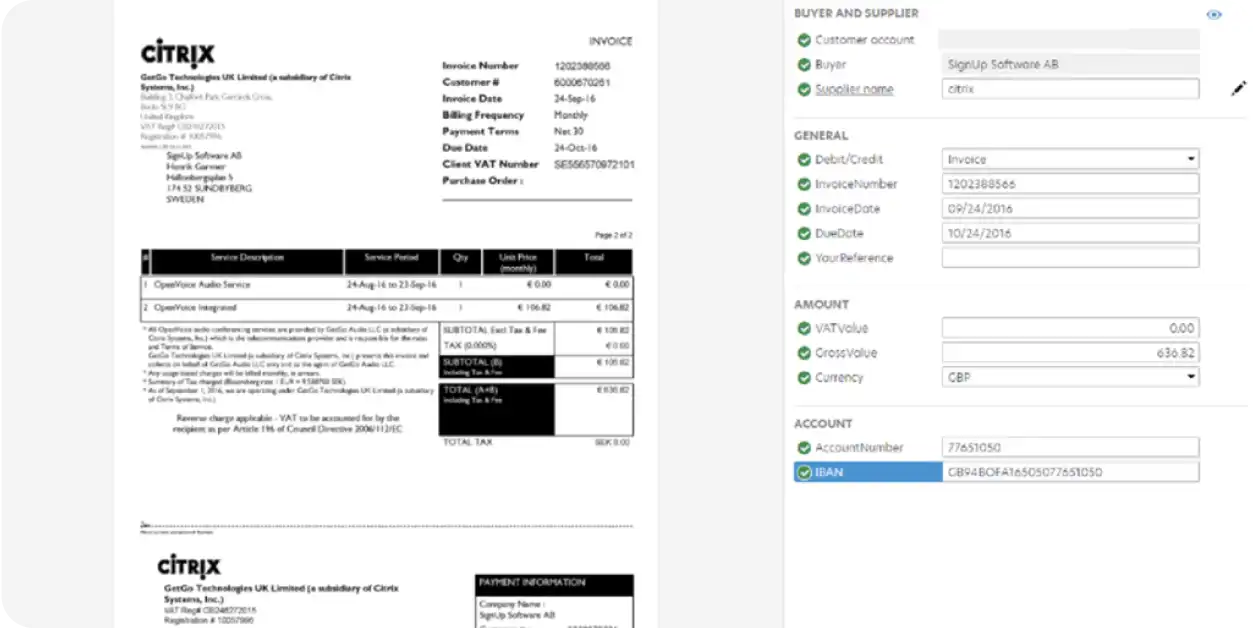

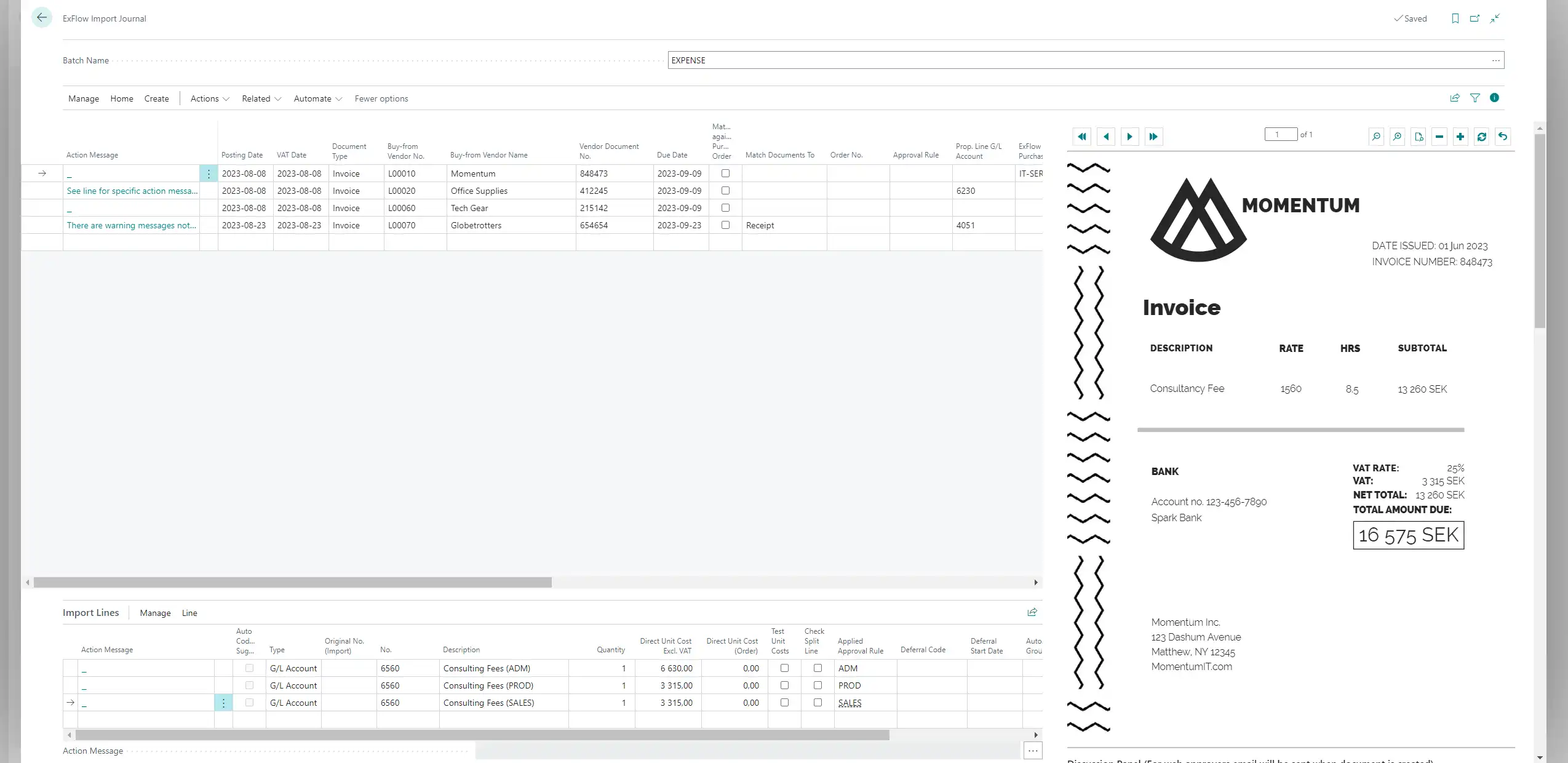

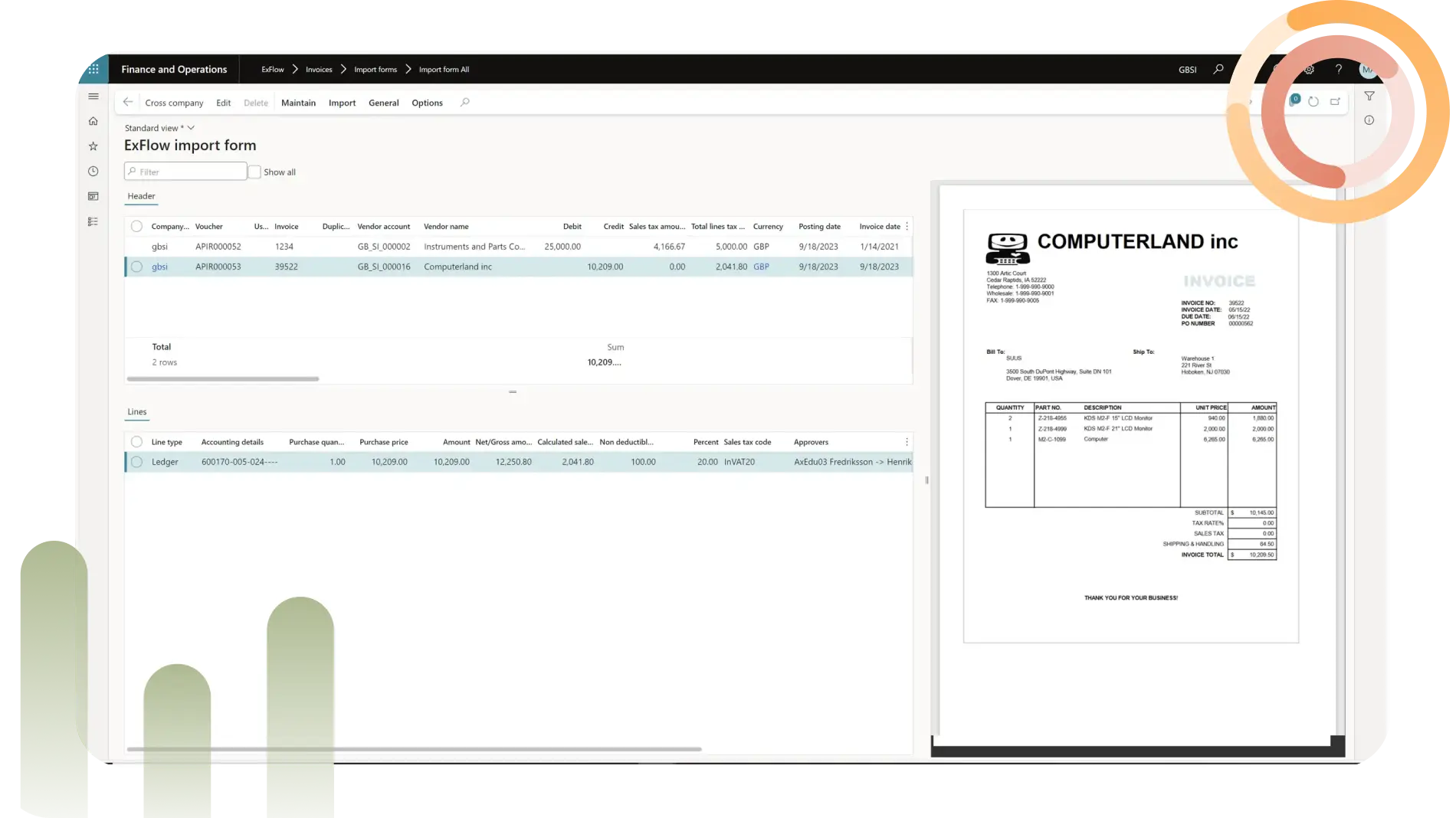

Our solution is purpose-built for Microsoft Dynamics 365 Finance & Operations and Business Central, helping you go beyond basic compliance to truly optimize your AP operations. By embedding directly into your ERP, ExFlow simplifies complex workflows, eliminates redundant manual tasks, and gives you full visibility and control over every invoice from start to finish.

Loved by 2000+ clients

How ExFlow AP Works

Curious to know more?

Book a demoBenefits of the Exflow D365 AP Automation Tool

Fraud Prevention

Reduce fraud risk by enforcing approval workflows and flagging any potential discrepancies. With validation checks and audit trails, you maintain control and prevent unauthorized payments.

Cost Reduction & Efficiency

Automate financial processes, significantly lowering operational costs and streamlining efficiency.

Enhanced Financial Control

Gain better control and oversight over financial workflows, enhancing compliance.

Global Support Network

Benefit from our extensive global partner network for expert support anywhere.

Real-Time Financial Insight

Achieve transparency and real-time insight into your financial operations, with data-driven decision-making.

Innovative Automation Features

Utilize advanced features of ExFlow AP automation, such as e-invoicing, to modernize financial management.

Take Control of Financial Process Operations with ExFlow AP

Automated Month-End Accrual Process

- Manual month-end accruals often lead to delays, errors, and inefficiencies. Automating this process allows you to:

- Streamline data collection and reconciliation across departments.

- Ensure real-time tracking of accruals for improved accuracy and timeliness.

- Free your finance teams to focus on strategic initiatives, reducing close cycle times by days.

Forecast with Ease

Make your financial data work for you. Optimize your budget and create better forecasts by leveraging all financial data within your ERP. ExFlow AP helps you to:

- Consolidate financial data on one unified platform for more accurate projections.

- Enable scenario planning and real-time forecasting to adapt to market changes.

- Minimize manual data handling, improving both speed and precision in financial planning.

Fraud Risk Mitigation

Without robust controls, organizations are exposed to fraudulent invoices, duplicate payments, and unauthorized transactions. AP automation helps you:

- Identify and flag anomalies in real-time with advanced analytics.

- Implement role-based access and approval workflows to prevent unauthorized payments.

- Strengthen overall financial security with AI-driven fraud detection capabilities.

Enhanced Compliance

Meeting evolving compliance standards is critical but challenging with manual processes. Automate your compliance workflows to:

- Maintain audit-ready documentation with detailed and transparent workflows.

- Reduce the risk of fines by ensuring timely and compliant submissions.

- Ensure adherence to global tax and e-invoicing standards with automatic invoice validation.

Stay Ahead of Global E-Invoicing Mandates

As e-invoicing mandates continue to roll out globally, staying compliant is more important than ever. ExFlow’s E-Invoicing solution ensures your business is ready to meet these demands while simplifying the complexities of regional laws and guidelines.

- Simplify Compliance: Automatically meet global tax regulations and e-invoicing standards.

- Navigate Complex Regional Laws: Adapt to varying e-invoicing requirements across different countries and regions with ease.

- Stay Future-Proof: Be prepared for evolving mandates and regulatory changes with a solution built to adapt.

Cut your costs and become more efficient

WORDS FROM SOME OF OUR CUSTOMERS

Check our case studies and see how other clients leveled up their business with our help