Blog

Purchase Order vs. Invoice: Everything You Need to Know

5 May

Blog

5 May

The ongoing management of purchase orders (PO) and invoices can be anything but straightforward, especially when you factor in high transaction volumes, error-prone manual workflows, and bottlenecks that delay approvals and strain vendor relationships.

For businesses on Microsoft Dynamics 365, getting the invoice and PO processes right is crucial to staying efficient and in control. The right tools take the busywork out of document management and turn it into something that helps the teams move forward.

Let’s review the key differences between a purchase order and an invoice, address common challenges accounts payable (AP) teams face, and share best practices for managing both more effectively.

Key highlights:

Purchase orders and invoices both play essential roles in the procurement process, but they serve very different purposes in accounts payable. Here’s how they work:

The table below takes a closer look at the difference between a purchase order and an invoice:

| Main Differences | Purchase Order | Invoice |

|---|---|---|

| Role in Procurement | Confirming what the buyer agrees to purchase | Requesting payment for goods or services delivered |

| Who Creates the Document | Sent by the supplier to the buyer | Sent by the supplier to the buyer |

| When It's Created | Before goods or services are delivered | After goods or services are delivered |

| What It Includes | Quantities, prices, delivery instructions, and agreed terms | Order details like what was delivered, final pricing, payment instructions, and due dates |

| How It Relates to Payment | Outlines terms of purchase but doesn’t request payment yet | Specifies the amount due, when it’s due, and how payment should be made |

While there are differences between a purchase order and an invoice, both are critical parts of AP workflows. When they’re connected properly using tools like D365 F&O, they create a full audit trail that makes financial tracking and management much easier.

Invoice and PO management remains a big pain point for many finance departments, especially those with high transaction volumes and complicated approval workflows. No wonder 64% of respondents to a SAP Concur report indicated they feel undue stress due to outdated AP processes.

Without an all-encompassing tool for accounts payable management in place, your team may face these common challenges:

Poor invoice and PO processing slows down AP and impacts accounts receivable (AR). According to a 2024 Versapay report, 77% of AR teams faced backlogs linked to delays and errors. As a result, organizations experience reduced cash flow and strained customer relationships, ultimately affecting their ability to fund operations, pursue growth opportunities, and maintain financial stability.

A solid process for handling invoices vs purchase orders can boost operational efficiency, regulatory compliance, and bottom-line results;all of which are core components of effective enterprise financial management. A clear workflow also promotes healthy relationships with suppliers, which can become strained when mismanaged payments create frustrating disputes and time-wasting communications.

These five best practices can help your team avoid errors and process invoices and purchase orders more effectively.

Slow invoice workflows are a cost driver that directly increases operational expenses. Implementing specialized AP automation software that integrates with your existing ERP can help minimize manual tasks and processing times, reducing the bottom line for organizations.

Case in point: According to an Ardent Partners report, using automation tools for invoice and purchase order management can help organizations reduce their processing costs by as much as 80%.

Learn how to select the best AP automation software for your organization.

Without consistency in how invoices are processed, approvals can drag on. Mistakes in complicated hierarchies can trigger extra reviews, and turnover can leave your team scrambling to adjust to new workflows while trying to stay current.

Establishing standard processes and applying solutions such as invoice automation creates clarity that survives personnel changes and reduces the learning curve for new team members.

Simple questions can remain unanswered for days when your team isn’t on the same page. Suppliers get frustrated chasing updates, and departments spend valuable time tracking basic information.

Whether creating shared dashboards or centralizing processes, streamlining communication between accounts payable, procurement, and other departments helps clear any confusion. It also signals to suppliers and partners that you’re reliable, which goes a long way toward building trust.

Mistakes can happen, even on the most organized teams. A small error on an invoice or a late approval can slow down the entire payment process, creating a ripple effect. In fact, according to PYMNTS, 40% of companies report that their inability to validate and process invoices quickly causes them to pay suppliers late.

That’s why it’s important to have automated tools that double-check POs against invoices, set clear deadlines, and flag anything that needs extra attention from AP teams.

Reviewing purchase orders, invoices, and payments helps you catch minor issues early before they become bigger finance and operations problems. Keeping up with reconciliation also makes spotting errors and strengthening your AP controls easier.

A regular, documented review process also helps you spot duplicate invoices, missed payments, or mismatches between what’s ordered and what’s billed. By making reviews a routine part of your AP process, businesses can avoid costly mistakes, increasing the accuracy of their cash flow forecasting and fiscal year-end reporting.

Streamlining the process of managing POs, invoices, and payments starts with your ERP. One of the top solutions used across industries, Microsoft D365, offers out-of-the-box tools for accounts payable to manage the entire procure-to-pay cycle within a platform rather than juggling disconnected tools and spreadsheets.

D365 features for efficient PO and invoice processes include:

D365 transforms procurement with tools that simplify sales order creation and approval routing. The platform keeps you in the loop with real-time delivery dates, supports global currencies, stores unique vendor terms, and links to inventory for accurate stock levels.

Procurement teams can rely on D365 for:

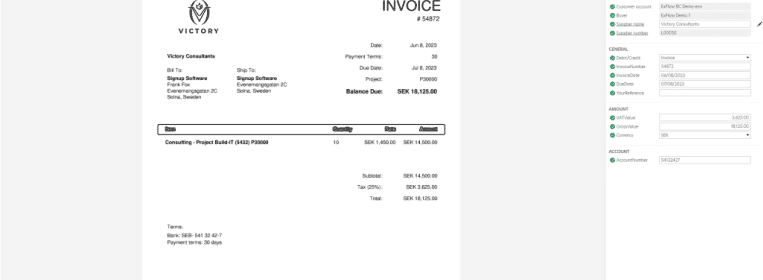

D365 invoice management streamlines workflows, helping to match purchase orders to invoices and post entries into your ERP. This feature is especially beneficial if you consider that non-PO invoices frequently encounter exceptions and cost more to process.

Your AP department can flag and quickly resolve any mismatches, keeping approvals and payments moving without unnecessary delays. D365 also offers:

Learn how invoice automation with ExFlow can transform your accounts payable with our comprehensive guide for teams using D365.

With Microsoft Dynamics, you can simplify vendor payments with scheduled transfers, prepayment support, and automatic reversals in the case of errors. There are also vendor portals that let your suppliers manage their information and track payments, helping reduce disputes and manual follow-ups that clog up your resources.

Smooth payment processing via D365 offers:

Dynamics 365 reporting capabilities give accounts payable teams real-time visibility into key metrics like aging invoices, vendor spending, and compliance risks. Instead of waiting for month-end reports, they can spot potential cash flow problems early and take action proactively.

Key insights available include:

Struggling with manual finance management processes and limited visibility? ExFlow can transform the D365 experience, integrating with your ERP system to automate the entire lifecycle — from initial data capture through validation, approval, and final posting — while providing the real-time insights and control that modern financial operations demand.

ExFlow improves D365 workflows with:

According to research by the Institute of Financial Operations & Leadership (IFOL), 56% of AP teams are partially automated, while 82% manually enter invoices into their ERP. ExFlow AP, for both F&O and Business Central, makes it easy for your team to bring streamlined functionality directly into D365, eliminating the need for third-party tools.

With real-time data syncing and fully embedded functionality, your department can process most invoices without manual work. The system also automatically manages invoice approval and payment processing, helping you move faster while making fewer errors.

Learn more about streamlining processes with our guide to AP automation with ExFlow.

ExFlow makes it easy for AP teams to skip manual data entry. The system automatically captures data from invoices — like vendor names, quantities, and prices — and checks them against records in Dynamics 365. Teams can spot and fix errors quickly, keeping the approval process fast, accurate, and hassle-free.

ExFlow AP supports e-invoicing across various international standards, allowing vendors to submit invoices directly into your system. This feature makes it easier for suppliers to get paid faster while ensuring you follow tax rules automatically. It also gives vendors real-time visibility into invoice status, which helps reduce back-and-forth communication.

With customizable approval flows and full audit tracking, ExFlow AP gives finance teams greater control over every invoice. Whether adding dual approval for high-value payments or applying different vendor rules, the system can be flexible to fit your policy. All actions get logged in real-time, so regulatory compliance is easier to manage, and reporting is more transparent.

This improved visibility and control extends to accounts receivable teams, who gain better insight into cash flow timing and can reduce collection issues related to disputed invoices.

Using advanced AP automation features built directly into the D365 ecosystem, ExFlow invoice management software helps to streamline accounts payable, boost AR efficiency, and drive better financial control for your entire organization.

The impacts can be significant. Take the example of the digital business services company Teleperformance, which once struggled to streamline invoice processing across multiple countries, but then saw a 76% reduction in processing time by fully implementing ExFlow. This efficiency gain allowed their team to focus on more strategic and varied initiatives within their company.

| Country/region | Time spent per invoice | Solution |

|---|---|---|

| Nordic countries | 4 minutes | ExFlow Data Capture (OCR) + ExFlow+ Dynamics ERP Standard |

| United Kingdom | 11 minutes | ExFlow Data Capture (OCR) + Dynamics ERP standard |

| France | 17 minutes | No OCR, Dynamics ERP standard |

Want to see similar AP results for your company? Book a demo today and discover how ExFlow’s D365 solutions can improve your purchase order and invoice processes.