Blog

The Complete Guide to Accounts Payable Digital Transformation

1 Oct

Blog

1 Oct

Manual accounts payable (AP) processes create bottlenecks. Paper invoices, duplicate data entry, and approval delays waste time and increase the risk of errors. Finance leaders know these inefficiencies limit visibility into cash flow and prevent the team from focusing on more strategic work.

AP digital transformation replaces those manual steps with automation, analytics, and integrated workflows. The result is faster invoice processing, fewer exceptions, stronger controls, and a clearer view of financial performance.

Let’s review how accounts payable digital transformation works and explore the necessary steps and best practices to improve your AP processes.

Key highlights:

Accounts payable digital transformation refers to the shift from manual, paper-based invoice management to automated, technology-driven workflows that enhance speed, accuracy, and control. Instead of clerks keying in data or chasing signatures, teams capture, code, approve, and pay invoices through digital systems that integrate with the broader finance stack.

The need to shift manual processes to automated workflows is evident as invoice volumes continue to increase. Ardent Partners reports that the average AP team needs 9.2 days to process a single invoice. With a digitized workflow that includes automation, that timeline can shrink to just 3.1 days. Delays of this magnitude tie up staff hours and prevent finance teams from:

Digital accounts payable tools replace the manual, time-consuming work with automation and visibility. By streamlining core AP tasks, finance teams lower costs, free up staff, and provide the transparency needed to support modern operations.

Transforming accounts payable goes beyond digitizing invoices, reshaping how finance teams operate. By automating routine tasks and building more intelligent workflows, AP departments unlock efficiency, reduce costs, and gain better oversight.

Here’s why digital accounts payable transformation is a strategic priority for modern finance operations:

AP teams often spend hours on manual data entry, chasing approvals, and resolving errors. These bottlenecks slow down the entire finance function. With digital transformation, invoices move seamlessly from receipt to payment in structured workflows that minimize delays and rework. Enterprises see increased efficiency because:

Every manual step in accounts payable increases invoice processing costs: paper, shipping, staff time, and late fees. Digital AP strips these costs out of the process and adds opportunities to save through early-payment discounts and better cash flow management. Transformation turns AP from a cost center into a driver of savings, as it offers:

Beyond hard cost savings, faster payment cycles improve supplier trust. A survey by SAP found that 51% of suppliers report that buyers are typically late with payments, which can negatively impact long-term vendor relationships.

Without real-time insight, finance leaders react to problems instead of preventing them. Digital transformation in accounts payable provides a comprehensive view of the entire invoice lifecycle, from capture through approval and payment. This visibility empowers better long-term financial forecasting, tighter budget control, and greater accountability across the business. Visibility and control improve through the use of:

Paper-based processes lack the safeguards needed in today’s risk environment. The Association for Financial Professionals found that 79% of enterprises were targeted by payment fraud in 2024, underscoring why stronger AP controls are no longer optional.

Digital AP systems enforce separation of duties, secure data, and provide comprehensive records, creating a stronger control environment that protects against fraud and supports compliance with internal policies and external regulations.

Robust digital transformation in AP strengthens security through:

Digital transformation in accounts payable is not a single upgrade; it’s a comprehensive process. It affects every core task finance teams manage. Automation is the foundation, but the impact extends to invoice approvals, payments, and supplier management. Together, these components create a streamlined and transparent AP function that reduces manual intervention and strengthens control.

| Tasks within Finance Departments | How They Are Affected by AP Digital Transformation |

|---|---|

| Invoice Processing | Digital capture and automated invoice coding replace manual entry, decreasing errors and increasing processing speed |

| Approval Workflow | Digital routing ensures invoices reach the right people instantly, eliminating delays caused by paper trails |

| Payment Processing | Electronic payments are scheduled automatically, improving accuracy and minimizing late fees |

| Supplier Management | Vendor data is centralized in one system so that finance teams can track terms, compliance, and relationships more effectively |

Even with clear benefits, AP transformation can face obstacles that slow momentum or block adoption. These issues are not unique, and nearly every finance team encounters them in some form. The difference between successful transformation and stalled progress often comes down to identifying these challenges early and implementing the right solutions.

Many finance teams still rely on ERP or accounting systems built years ago, long before modern AP automation solutions were an option. Plugging new tools into those environments is rarely straightforward, and without a plan, integration issues can derail an otherwise strong project.

To reduce friction with legacy platforms, finance leaders should:

Automation magnifies bad data. If invoices are incomplete or inconsistent, exceptions clog workflows and delay approvals, so staff spend just as much time troubleshooting as they did before the transformation. Data quality improves when teams take steps such as:

Transformation is as much about people as it is about technology. Employees who have relied on paper or email approvals for years may resist new systems, and without their buy-in, adoption slows. If change feels imposed rather than collaborative, finance teams struggle to get the full return on investment.

Change management works best when leaders:

Supplier adoption often determines whether transformation succeeds, since hybrid paper-and-digital processes erase many efficiency gains. Onboarding can become a bottleneck unless organizations make it quick, providing clear instructions and demonstrating to suppliers that digital invoicing leads to faster payments.

Supplier adoption of digital transformation improves when companies:

AP automation requires investment in software, training, and occasionally consulting services. Leaders need to demonstrate value quickly to justify spending and keep projects funded. If savings are not tracked and reported with hard data, stakeholders may dismiss transformation as unnecessary spending. Teams can strengthen ROI by:

Learn how to determine your accounts payable automation ROI.

Organizations that span multiple entities or regions face added complexity. Currency differences, tax requirements, and approval hierarchies can complicate the standardization process. Without the proper configuration, a digital AP system designed for simplicity in one market may create confusion in another.

Global complexity is easier to manage with:

Even the best technology fails without proper training. AP teams need to understand both how to use the new tools and why the processes are changing. Without ongoing support, tech adoption plateaus and users return to old habits, reducing the impact of the investment.

Digital modernization training is more effective when organizations:

AP digital transformation is most effective when approached as a structured journey rather than a one-time technology purchase. A clear roadmap helps finance teams align their goals, manage change effectively, and measure results.

Here are the five steps to move from manual workflows to a fully digital accounts payable function:

Every transformation starts with understanding the current state. Without a baseline, it is impossible to measure improvement or identify where automation will deliver the most significant impact. Reviewing processes, costs, and cycle times gives leaders a realistic picture of what needs to change.

Your assessment of existing AP processes should focus on:

Clear objectives keep projects focused and measurable. Goals should connect accounts payable transformation to broader finance and business priorities, whether that means faster month-end closes or improved cash flow visibility due to enhanced AP reporting capabilities. Without specific targets, teams risk implementing technology without proving its value.

Strong goal setting involves:

With goals defined, the next step is choosing the right platform. Technology should meet both current needs and long-term growth objectives of your accounts payable team, and it must seamlessly integrate with existing accounting tools. Rushing this step often leads to mismatched solutions that fail to deliver promised efficiencies.

Effective technology selection includes:

Poor implementation can undermine even the best AP transformation strategy. Phasing deployments, involving your team and suppliers, and closely monitoring early results, ensures that the system integrates smoothly into existing accounts payable operations. Success requires balancing speed with stability.

The implementation of AP modernization is most effective when teams:

AP transformation is not a one-time project. Finance teams that regularly review performance and refine workflows see greater value over time. Continuous improvement of your accounts payable function after your initial transformation ensures that systems evolve in line with technology trends and business needs.

Continuous improvement of your AP processes works through:

Technology is only part of accounts payable transformation. Long-term success depends on how finance teams design processes, secure data, and collaborate across the business.

Follow these best practices to ensure digital AP adoption delivers consistent value and avoids common pitfalls.

Fragmented workflows create confusion and delays. Centralizing AP activities in a single system provides finance leaders with complete visibility while reducing duplicate work. A unified process also makes it easier to enforce consistent policies across locations or entities.

AP centralization works best when organizations:

Accounts payable handles sensitive financial data and is a common target for fraud. Strong security measures protect the organization and ensure compliance with regulatory requirements. Teams must incorporate security into their systems and processes from the start.

Security best practices include:

Automated workflows create a stream of data that goes far beyond invoice totals. Analytics help finance teams spot trends, improve forecasting, and identify opportunities to save. Without analytics, organizations miss the strategic value of digital transformation in AP.

Data analytics deliver value when AP teams:

Accounts payable does not operate in isolation. Procurement, finance, and business units all touch invoices and suppliers in different ways. For AP leaders, building collaboration ensures digital workflows support broader company goals, reduce departmental friction, and highlight the strategic value of the finance function.

Collaboration strengthens digital transformation when AP leaders:

AP technology continues to evolve with new features, compliance demands, and integration options. Staying current ensures finance teams maximize value and remain competitive. Ignoring new tech developments risks falling back into inefficiency.

Staying current with AP technology trends requires organizations to:

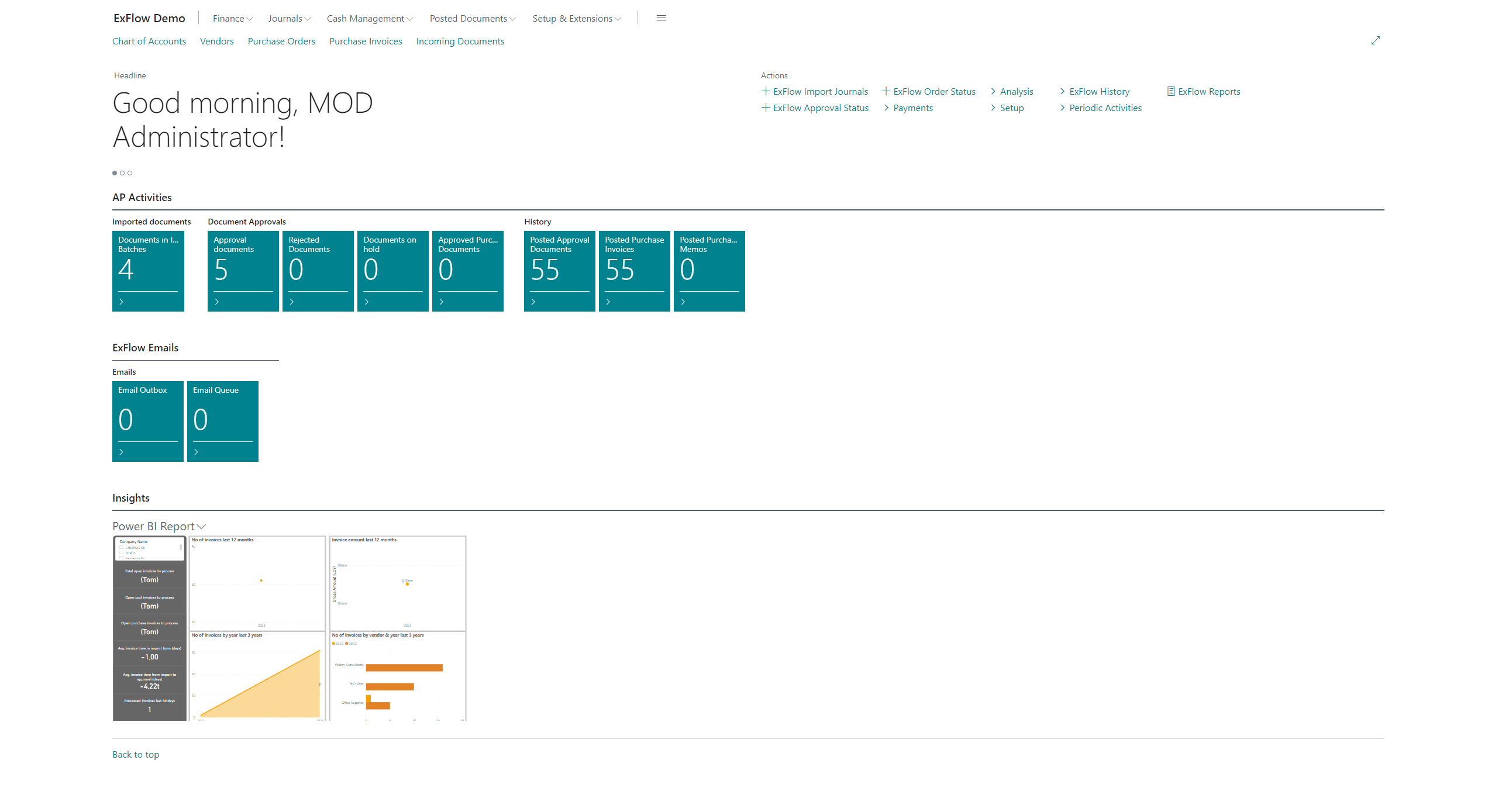

ExFlow empowers modern organizations to transform their accounts payable operations by embedding end-to-end automation directly in Microsoft Dynamics 365 for both Finance & Operations and Business Central users.

Forward-thinking AP teams benefit from:

Book a demo today and make ExFlow AP a part of your accounts payable digital transformation initiative.