The retail industry is fast-paced, hectic, and highly competitive, so why should your financial processes be stuck in the slow lane? With ExFlow’s AP automation for retailers, you can streamline and optimize your financial management, leaving behind the manual, error-prone workflows of the past.

Common Challenges in Retail Finance Processes

Managing finances in the retail sector isn’t exactly a breeze. Between processing hundreds of invoices, managing vendor relationships, and ensuring smooth cash flow across stores and online platforms, financial management in retail comes with unique challenges.

Financial management issues in retail:

- High volume of invoices: Manual processing takes time, and human error is inevitable.

- Complex vendor management: Retailers often work with hundreds of vendors, and keeping track of each relationship can be a logistical nightmare.

- Cash flow visibility: Ensuring liquidity across multiple locations or stores, while managing peak seasons, is challenging.

Retail AP automation with ExFlow simplifies all these processes, so you don’t have to spend time fighting fires; you can focus on growing your business instead.

How ExFlow Solutions Benefit Retail Businesses

Automated Accounts Payable Workflows

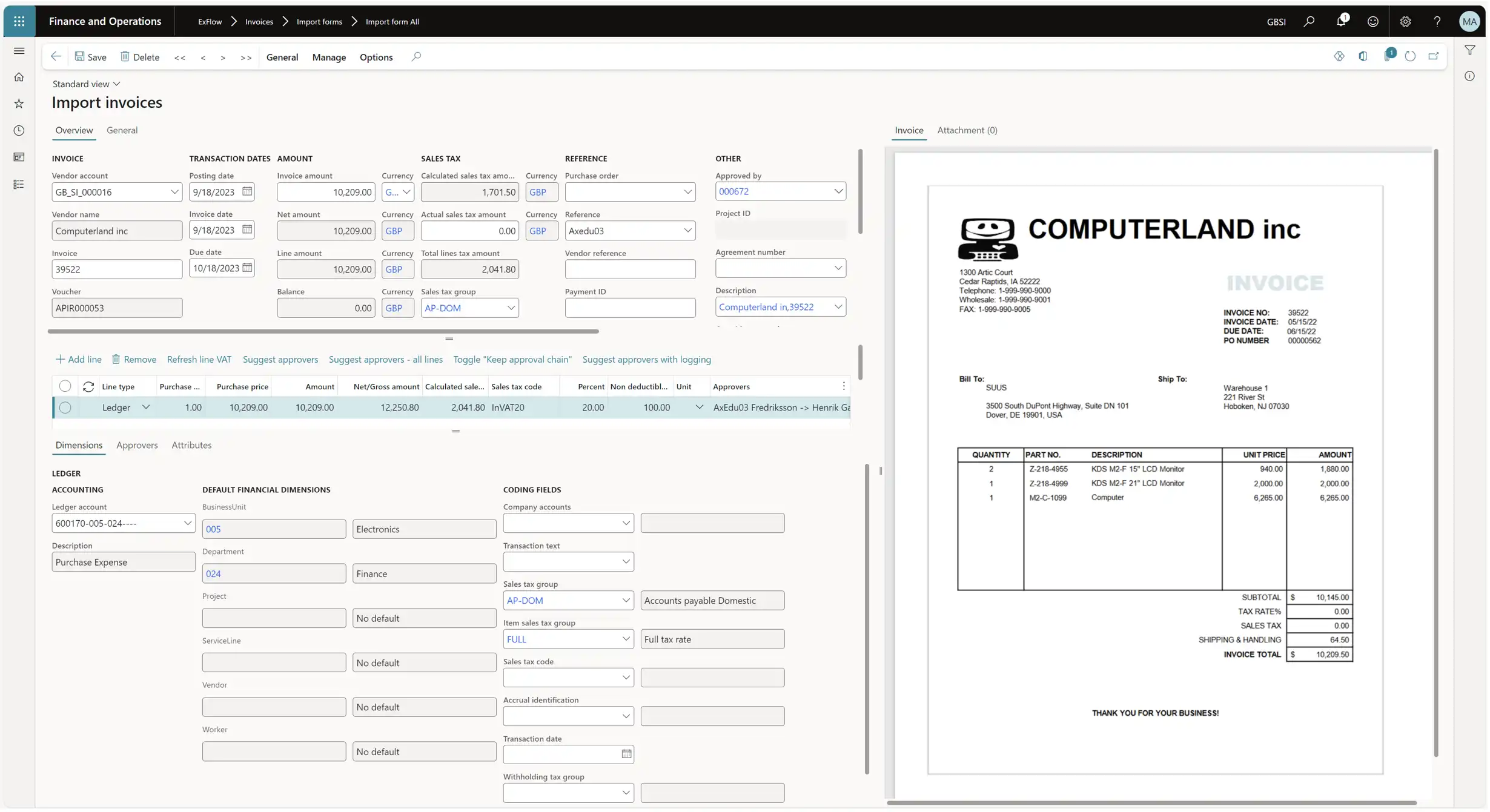

ExFlow’s retail AP automation streamlines invoice processing by being built right into Dynamics 365. Forget manual data entry — our solution automatically matches purchase orders with invoices, ensuring that your payments are processed on time and with minimal human intervention. The result? Faster payment cycles and a healthier bottom line.

Enhance Inventory Management

Financial mismanagement can wreak havoc on your inventory control. With ExFlow, your financial data is cohesively merged with your inventory systems, giving you real-time insights into stock levels, costs, and vendor payments. Better cash flow management means better inventory decisions, reducing stockouts or over-ordering.

Streamline Retail Cash Flow Management

ExFlow helps you maintain visibility into your cash flow, even during high-volume periods like the holiday season. With AP automation software for retail that supports real-time reporting, you can easily see which invoices are pending, prioritize vendor payments, and optimize your cash flow management to prevent liquidity issues before they arise.

Key Features of ExFlow’s AP Automation Software for Retail

ExFlow provides retail businesses with the tools to streamline financial workflows, automate accounts payable, and reduce administrative costs. Whether you’re looking to eliminate manual invoice processing or improve vendor relationships, our AP automation for retailers is designed to transform your financial management processes.

Invoice Processing Automation

With the volume of invoices retailers handle daily, manual processing is a serious bottleneck. ExFlow automates the entire process, from data entry to approvals, helping you process invoices more efficiently and accurately. The built-in automation reduces errors, improves accuracy, and speeds up the overall workflow.

Expense Management and Analysis

Retailers deal with many variable expenses, from store maintenance to seasonal advertising. ExFlow provides comprehensive expense management tools, enabling you to track, analyze, and control every dollar spent. Plus, its built-in analytics features offer valuable insights into spending patterns, so you can cut unnecessary costs and make smarter financial decisions.

Vendor Management Integration

Managing relationships with numerous suppliers is a challenge, especially when payments are delayed or invoices are disputed. ExFlow integrates vendor management into your financial system, making it easy to track payments, resolve disputes, and strengthen partnerships. Stay on top of retail vendor relationships with automated reminders and transparent reporting.

Benefits of ExFlow AP Automation for Retailers

Why Choose ExFlow for Retail?

Industry Expertise

ExFlow’s deep understanding of the retail industry means that we tailor our automation software for retail specifically to your business’s needs. We’ve worked with retailers of all sizes, from large multinational chains to independent stores, and understand the unique challenges you face.

Scalability and Flexibility

Whether you’re managing one store or a hundred, ExFlow’s scalable retail AP automation platform grows with your business. It is flexible enough to handle the complexities of both small and large retailers, offering solutions that fit your business no matter the size.

Automated Reporting and Analytics

Make data-driven decisions with ExFlow’s powerful reporting and analytics tools. From vendor performance to payment schedules, our system offers real-time insights that keep you in control of your finances.

Book a demo

See for yourself how ExFlow can revolutionize your retail financial management processes. Our team is here to show you the benefits of automation in action and help tailor a solution for your unique business needs.

Frequently Asked Questions

What Is Retail AP Automation?

Retail AP automation refers to the use of software to digitize and streamline accounts payable processes such as invoice capture, validation, approvals, and posting. Instead of relying on manual data entry and paper based workflows, retailers use AP automation to process high invoice volumes faster, reduce errors, and gain better visibility into cash flow.

Why Has AP Automation for the Retail Industry Become So Critical?

Retailers operate in fast moving, high volume environments with tight margins, seasonal fluctuations, and complex supplier networks. AP automation helps retail organizations keep pace by improving processing speed, reducing costs, and supporting scalability as the business grows. Solutions like ExFlow for D365 are especially valuable because they are built directly into Microsoft Dynamics 365, enabling retailers to automate AP without disrupting existing financial processes.

What Tasks Can I Streamline with AP Automation Software for Retail?

Retail AP automation can streamline invoice data capture, three way matching, approval workflows, posting, reporting, and payment scheduling. It also helps retailers take advantage of early payment discounts by ensuring invoices are approved and processed on time. By using modern accounts payable automation, finance teams spend less time on manual tasks and more time on strategic work.

Why Should I Use a D365-Native Solution like ExFlow to Automate AP Staff Workflows?

A D365 native solution like ExFlow is built directly into Microsoft Dynamics 365, which means no integrations, no data silos, and a familiar user experience for AP teams. This supports proven AP automation practices such as standardized workflows, role based approvals, and real time visibility, all while reducing IT complexity and maintenance.

How Does AP Automation for Retail Improve Supplier Relationships?

Reliable and timely supplier payments are critical in retail, where supplier relationships directly affect inventory availability and pricing. AP automation improves invoice accuracy, reduces payment delays, and increases transparency for both internal teams and suppliers. Over time, this consistency helps retailers strengthen vendor relationships and negotiate more favorable terms.

How Does AP Automation for Retailers Help Improve Compliance Across Multiple Regions?

Retailers operating across multiple regions must comply with varying tax rules, reporting requirements, and financial regulations. AP automation supports regulatory compliance by enforcing consistent processes, capturing approvals electronically, and maintaining detailed audit trails for every invoice and transaction. This makes audits faster, simpler, and less disruptive.

What Metrics Can Retailers Use to Measure the ROI of AP Process Automation?

Retailers commonly measure ROI by tracking cost per invoice, invoice processing time, error rates, on time payment performance, and captured early payment discounts. Additional indicators include improved staff productivity, reduced audit preparation time, and better cash flow visibility, all of which contribute to long term financial and operational gains.

How Long Does It Take to Implement ExFlow’s AP Automation Software for Retail Business?

Implementation timelines vary depending on the size and complexity of the retail organization, but ExFlow is typically faster to deploy than non native solutions because it is built directly into Dynamics 365. Many retailers can go live in weeks rather than months, with minimal disruption to daily operations.

What Are the Common Challenges When Transitioning from Manual to Automated AP in Retail?

Common challenges include change management, process standardization, and helping staff adapt to new workflows. However, with a clear rollout plan, training, and stakeholder involvement, AP automation becomes a natural part of a retailer’s broader digital transformation, delivering quick wins and long term efficiency improvements.