ExFlow simplifies manufacturing accounts payable automation, ensuring seamless operations through Dynamics 365 integration, helping you control costs, improve cash flow, and reduce manual tasks.

Common Challenges of AP in Manufacturing

Manufacturing companies often face challenges like delayed supplier payments, complex cost allocation, and limited visibility into financial operations. The large number of invoices and transactions, along with managing big inventories, requires a reliable system that helps reduce errors and delays.

Without proper AP automation for manufacturing, your financial processes can become a burden that impacts production schedules and profitability.

How ExFlow Manufacturing AP Technology Benefits Companies

Automated Accounts Payable Workflows

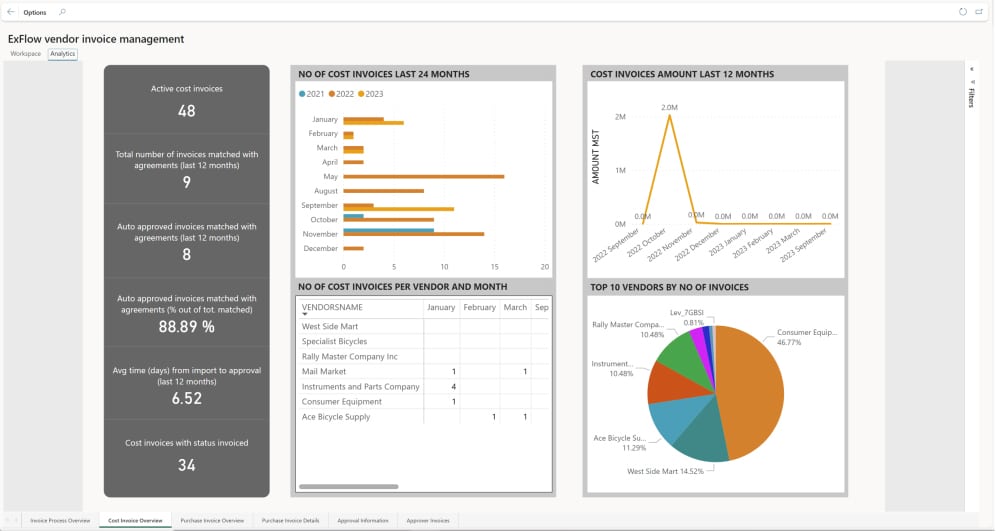

ExFlow solutions are tailored to meet the unique needs of manufacturing companies, offering automated accounts payable workflows to streamline financial operations and improve cost management. From invoice processing to supplier payments, our solutions enable manufacturers to optimize cash flow, reduce processing times, and enhance financial visibility.

The result? Faster approvals, fewer human errors, and more efficient financial workflows that keep your operations running smoothly.

Enhance Inventory Management & Cost Control

Inventory management plays a critical role for manufacturers. With ExFlow’s AP automation for manufacturing, you can combine inventory costs with your financial workflows. This helps you track expenses in real time. This inclusion enables you to manage procurement and inventory more efficiently, allowing for better cost control and reduced stock wastage.

Key Features of ExFlow Manufacturing Accounts Payable Automation Solutions

Invoice Processing Automation

Manual data entry and invoice handling can lead to delays and errors. ExFlow automates invoice processing, capturing and validating invoices, and matching them with purchase orders in Dynamics 365 for manufacturing. This ensures timely payments, accurate financial records, and reduces the risk of discrepancies between purchase orders and actual deliveries.

Cost Allocation and Analysis

Manufacturing companies deal with a wide range of costs—raw materials, labor, equipment, and more. Manufacturing accounts payable automation from ExFlow simplifies allocation by automating the categorization of expenses, allowing you to analyze costs by project, department, or product line. This feature gives you greater control over your finances and helps identify areas where cost savings can be realized.

Inventory Management Integration

Synchronicity with your inventory management system is crucial. With ExFlow, you can align costs with your financial workflows, giving you real-time visibility into how stock levels and procurement impact your bottom line. This smooth interfacing enables better cost forecasting and inventory optimization, ensuring that you avoid overstocking or understocking critical materials.

Benefits of ExFlow AP Automation Software for Manufacturing

Operational Efficiency

Efficiency is the name of the game, and ExFlow’s AP automation for manufacturing ensures your financial processes run like a well-oiled machine. By automating repetitive tasks, like invoice approvals and cost tracking, your team can focus on more strategic initiatives, driving overall productivity and ensuring your financial operations are always up-to-date.

Cost Control

Tight cost control is essential in the manufacturing industry, where profit margins can be thin. ExFlow’s accounts payable automation helps reduce unnecessary expenses by improving the accuracy of supplier payments, tracking costs in real-time, and eliminating duplicate payments.

Compliance and Risk Management

With global supply chains, manufacturers face an array of regulations. ExFlow simplifies compliance by automating audit trails and document storage, ensuring that your financial processes meet local and international requirements. This reduces risk and helps avoid costly compliance breaches.

Why ExFlow Provides the Best AP Automation for Manufacturing

Our Customers in the Manufacturing Industry

ExFlow has helped numerous manufacturing companies streamline their financial processes. By automating accounts payable and unifying financial operations with Dynamics 365, we’ve enabled companies like Peikko Group Oy to improve financial visibility, reduce processing times, and increase operational efficiency.

BOOK A DEMO

Ready to see how ExFlow can revolutionize your manufacturing company’s financial operations? Schedule a demo today to explore how ExFlow’s tailored solutions can help you automate financial workflows, enhance cost control, and improve operational efficiency.

Frequently Asked Questions

What Is Accounts Payable Automation for Manufacturing?

Accounts payable automation for manufacturing refers to using digital tools to manage the entire AP workflow. It covers every step from invoice receipt and approval to payment and reconciliation within a single, connected system. Instead of relying on manual data entry, paper invoices, or scattered email threads, automation captures and routes invoices electronically, saving time and reducing errors.

For manufacturers handling large volumes of supplier invoices, automation provides structure, accuracy, and visibility. It helps finance teams eliminate bottlenecks, improve consistency, and gain better insight into cash flow and supplier performance across multiple sites or entities.

Why Is Manufacturing Accounts Payable Automation Critical for Companies?

Manufacturing organizations often face complex supplier networks and multi-location operations that make manual invoice handling slow and unreliable. AP digital transformation helps companies overcome these challenges by connecting procurement, invoice management, and payments inside one platform. This streamlines approvals and ensures data accuracy across all departments.

Automation also reduces the risk of delayed payments or missed discounts, both of which can damage supplier relationships. By providing real-time visibility into payables and compliance, it helps manufacturers stay competitive while maintaining full financial control.

How Does Manufacturing AP Automation Work?

Manufacturing AP automation connects each stage of the invoice lifecycle into one digital process. The system automatically:

- Uses OCR invoice scanning to extract supplier details, invoice numbers, and amounts.

- Matches invoices to purchase orders and goods receipts for verification.

- Routes invoices to the correct approvers based on company rules or departments.

Once approved, the invoice data moves directly into the ERP for posting and payment. For Microsoft Dynamics 365 users, this workflow eliminates repetitive manual work, shortens approval times, and keeps every transaction traceable within the same secure environment.

What Are the Main Benefits of AP Automation for Manufacturing?

Automating accounts payable delivers clear and measurable improvements for manufacturers. Key benefits include:

- Stronger supplier partnerships and on-time payments that improve supplier relationships

- Significant savings through reduced invoice processing cost.

- Improved compliance and audit readiness with full data traceability and invoice validation.

- Faster invoice approvals that free staff to focus on higher-value work such as forecasting and analysis.

The result is a more efficient, accurate, and resilient financial process that keeps production running smoothly and suppliers confident in your reliability.

How Does ExFlow’s Automation Solution Enhance the Capabilities of Microsoft D365?

ExFlow’s AP automation solution is built entirely within Microsoft Dynamics 365 Business Central and Finance & Operations. This means all invoice data, approvals, and payments stay inside the ERP, preserving data accuracy and security without the need for external integrations.

For manufacturers, that translates into better control, fewer data silos, and easier reporting. ExFlow automates tasks like invoice matching, vendor management, and payment scheduling, all while leveraging Microsoft’s native tools and scalability.

Can AP Automation Software for Manufacturing Help Prevent Fraud and Duplicate Payments?

Yes. Modern automation platforms are equipped with AP fraud prevention tools that protect companies from payment errors and fraudulent activity. Features like vendor verification, duplicate detection, and digital audit trails create strong internal controls and ensure that every transaction is verified before release.

In a manufacturing environment with multiple suppliers and frequent transactions, these safeguards are vital. Automation reduces the chance of human error and makes it easier to track responsibility for every approval or payment, strengthening financial security across the organization.

How Does AP Automation Improve Cash Flow Management in Manufacturing Environments?

Automation improves cash flow by giving finance teams a real-time view of invoices, liabilities, and payments. With complete visibility, decision-makers can forecast more accurately, time payments strategically, and optimize budget planning.

When approvals move faster and payment cycles become more predictable, manufacturers can take advantage of early payment discounts and maintain steady supplier relationships. This kind of financial clarity helps avoid surprises, ensures liquidity, and supports long-term planning.

What Are the Common Challenges of Implementing Automation for AP in Manufacturing?

Adopting accounts payable automation in a manufacturing company can be challenging when older systems, manual processes, or siloed data are still in place. Integration between finance, procurement, and production systems requires careful planning to avoid workflow disruptions.

The most successful implementations start with a clear rollout plan, employee training, and phased deployment. Once the system is fully operational, companies typically find that efficiency gains, transparency, and cost savings far outweigh the initial setup effort.

How Long Does It Take to See ROI from an AP Automation Solution?

Most manufacturing companies begin to see measurable AP automation ROI within six to twelve months of implementation. The speed of return depends on invoice volume, process complexity, and how quickly teams adopt the new system.

Savings come from reduced manual labor, faster invoice cycles, and fewer payment errors. Over time, automation also leads to stronger supplier relationships and better financial control, creating value that continues to grow year after year.